Korian and Pilavjian Join ANCA for Consultations at State Department and across Capitol Hill

WASHINGTON—Leading U.S. investors in Yerevan’s landmark Marriott Hotel made the case this week in Washington for a U.S.-Armenia Double Tax Treaty during a series of Capitol Hill and State Department meetings, reported the Armenian National Committee of America (ANCA).

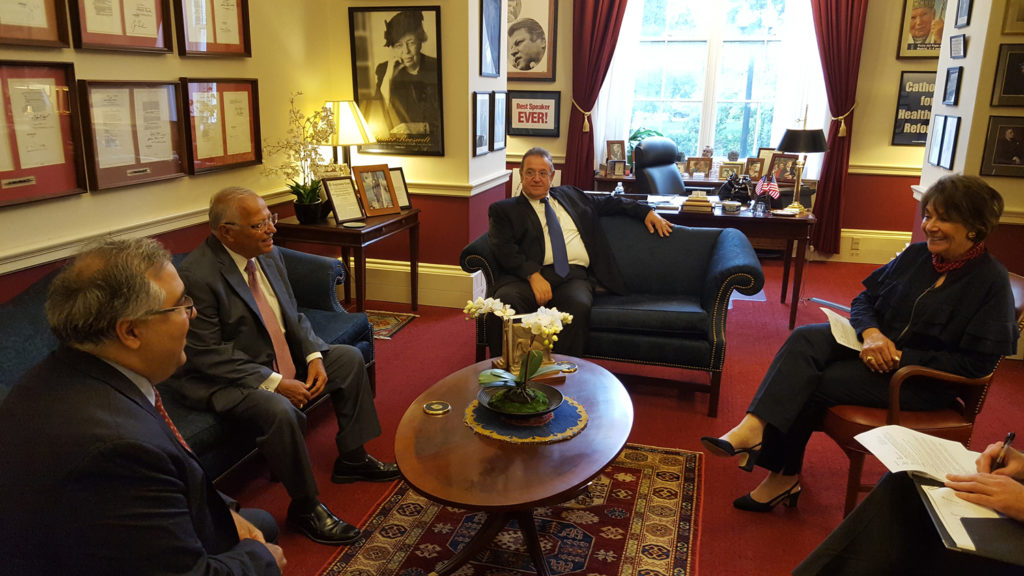

Rep. Anna Eshoo (D-Calif.) with Armenia Marriott’s Paul Korian and Peklar Pilavjian and the ANCA’s Aram Hamparian

“We were pleased to have this opportunity to share with U.S. legislators and our Department of State the real-world benefits of a Double Tax Treaty for U.S. investors, the Armenian economy, and—perhaps most importantly—the future growth of mutually beneficial bilateral U.S.-Armenia commercial relations,” said Paul Korian, chairman and managing partner of the Armenia Marriott Hotel Complex.

“By eliminating the threat of double taxation, this long overdue treaty would remove a meaningful barrier to the expansion of the U.S.-Armenia economic relationship, opening the door to a new wave of investment opportunities,” said investor Peklar Pilavjian.

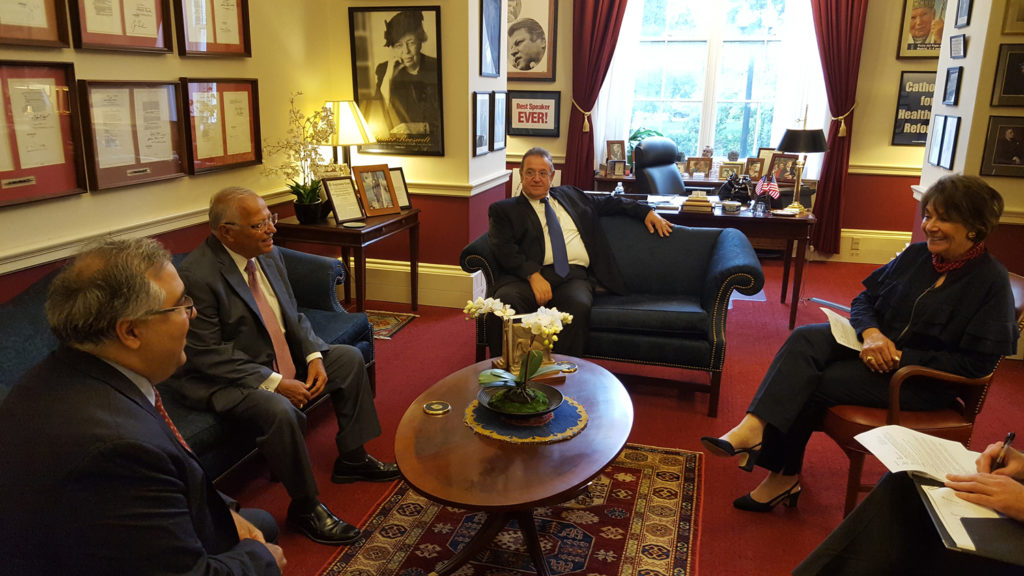

Paul Korian, chairman and managing partner of the Armenia Marriott Hotel Complex, investor Peklar Pilavjian, and the ANCA’s Aram Hamparian discussing the benefits of a U.S. Armenia Double Tax Treaty with Senior House Foreign Affairs Committee member and international tax expert Rep. Brad Sherman (D-Calif.)

Among the legislators that the group spoke with on Capitol Hill were Armenian Caucus Co-Chairs Jackie Speier (D-Calif.) and David Trott (R-Mich.), senior House Foreign Affairs Committee member Brad Sherman (D-Calif.), who is widely respected as the leading Congressional expert on international tax law, and U.S. Representatives Anna Eshoo (D-Calif.), Joseph Kennedy (D-Mass.), and Grace Napolitano (D-Calif.). Korian and Pilavjian also took part in a State Department meeting on the mutual benefits of a Double Tax Treaty.

“It’s time to get this done. The absence of a working, modern tax treaty has—for far too long—deprived both U.S. and Armenian investors of a clear legal framework, creating unnecessary uncertainty that diverts investment flows and materially disadvantages businesses,” said ANCA Executive Director Aram Hamparian. “Inaction on a Double Tax Treaty, more than 25 years after Armenia’s independence, sends the wrong message to potential investors and other economic stakeholders.”

Armenia Marriott’s Paul Korian and Peklar Pilavjian and the ANCA’s Aram Hamparian with Congressional Armenia Caucus Co-Chair Jackie Speier (D-Calif.) and Chief of Staff Josh Connolly at the historic Rayburn Room, just steps from the U.S. House floor

Following the meetings, Korian and Pilavjian talked to H1 Television’s Haykaram Nahabetyan about the benefits of a U.S.-Armenia Double Tax Treaty in the ongoing efforts to expand bilateral economic ties. The group also visited with Library of Congress Armenian Specialist Dr. Levon Avdoyan for a first-hand view of the libraries’ over 40,000 Armenian holdings.

Armenia Marriott’s Peklar Pilavjian and Paul Korian with Congressional Armenian Caucus Co-Chair Dave Trott (R-MIich.) and the ANCA’s Aram Hamparian

Photos from the visits are available on the ANCA Facebook page at:

A U.S.-Armenia Double Tax Treaty would establish a clear legal framework for investors and individuals who have business activities in both jurisdictions, preventing double taxation and facilitating the expansion of economic relations. It would also help reinforce the friendship of the American and Armenian peoples, anchoring Armenia to the West, and providing Yerevan with greater strategic options and independence in dealing with regional powers.

The outdated 1973 U.S.-U.S.S.R. Tax Treaty—recognized by the U.S. but not Armenia—is inadequate to meet the needs of present-day U.S.-Armenia relations. While investors have found ways to adjust to its inadequacies, the existing system of foreign tax credits and deductions is not consistent with any accepted tax or accounting system.

The U.S. has Double Tax Treaties with many small countries, including Estonia, Jamaica, Latvia, Lithuania, Malta, and Slovenia. Armenia has Double Tax Treaties with many advanced countries, including Austria, Belgium, Canada, China, France, Italy, the Netherlands, Poland, Russia, and the United Kingdom.

Source: Armenian Weekly

Link: ANCA and Marriott Armenia Make Case to Congress for U.S.-Armenia Double Tax Treaty