WASHINGTON—In the wake of Armenia’s peaceful, constitutional political transition—a move broadly welcomed among Washington, D.C. policymakers as marking a new chapter in U.S.-Armenia relations—the Armenian National Committee of America (ANCA) has renewed its longstanding drive for a U.S.-Armenia Double Tax Treaty, a good-governance accord needed to break down artificial barriers to the growth of bilateral trade and investment.

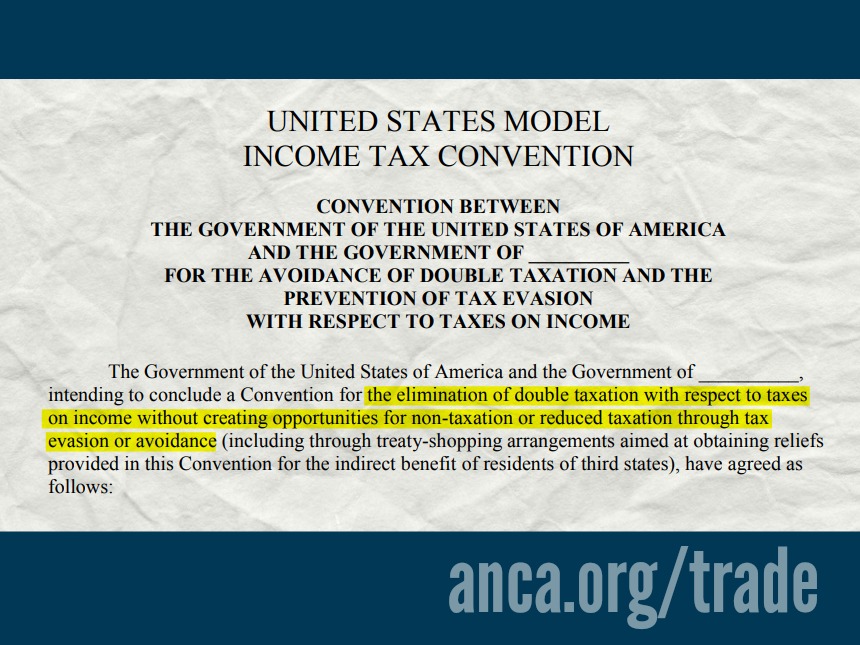

The Republic of Armenia has expressed its willingness to start treaty talks on the basis of the 2016 “U.S. Model Income Tax Convention,” a standard template used by many nations in reaching agreements with the United States. This model treaty prioritizes the transparent exchange of information, a hallmark of good governance and a statutory check, enforced by both parties, against attempted “non-taxation or reduced taxation through tax evasion or avoidance.”

“We are encouraged by the result of our recent meetings with Administration officials and Congressional leaders, during which we stressed our strategic priority of strengthening U.S.-Armenia ties, with a strong focus on broad-based, sustainable economic cooperation,” said ANCA Chairman Raffi Hamparian. “We look forward to continuing our work with stakeholders in Washington, DC and Yerevan to put this accord in place and also advance a broad array of other initiatives – in the economic, political and military arenas – aimed at broadening and deepening the longstanding friendship of the American and Armenian peoples.”

In February of this year—in response to a Congressional letter spearheaded by Armenian Caucus Co-Chair David Valadao (R-Calif.) and senior Foreign Affairs Committee member Brad Sherman (D-CA), and signed by 31 U.S. Representatives—U.S. Secretary of Treasury Stephen Mnuchin pledged to devote Treasury Department staff resources to exploring a Double Tax Treaty with Armenia. These legislators stressed the urgency of renegotiating the existing, outdated Double Tax Treaty with Armenia, an obsolete Cold War-era accord—recognized today by the U.S. but not Armenia—that was negotiated with the now defunct U.S.S.R. more than four decades ago.

“American and Armenian businesses have close ties and it’s time to end the double taxation currently imposed on businesses in both nations,” explained Rep. Valadao. “By renegotiating our tax treaty with Armenia, we can continue to strengthen our relationship with a close ally while encouraging trade and investment in our great nations,” he continued. “Modernizing our double tax treaty with Armenia is long overdue,” explained Rep. Brad Sherman (D-Calif.), who pressed Secretary Mnuchin on the issue during a House Financial Services Committee hearing in February. “This is not only an opportunity to reaffirm our friendship with Armenia, but to also create new opportunities for investment and growth.”

Background

Following the signing of the U.S.-Armenia Trade and Investment Framework Agreement (TIFA) in 2015, the ANCA has been working closely with a broad range of legislators to encourage the Department of Treasury to negotiate a new U.S.-Armenia Double Tax Treaty. In September 2017, the ANCA joined with Paul Korian and Peklar Pilavjian, leading U.S. investors in Yerevan’s landmark Marriott hotel, for a series of Capitol Hill and State Department meetings making the case for an updated compact. Internationally renowned Tufenkian Artisan Carpets; Triada Studio, the Armenia-based creator of the Apple Design Award-winning Shadowmatic Game; and PicsArt, the Yerevan and San Francisco based makers of one of the most popular photo-editing, collage and drawing apps, are among the many firms urging the lifting of barriers to U.S.-Armenia trade through the implementation of a new double-tax treaty.

A U.S.-Armenia Double Tax Treaty would establish a clear legal framework for investors and individuals that have business activities in both jurisdictions, preventing double taxation and facilitating the expansion of economic relations. It would also help reinforce the friendship of the American and Armenian peoples, anchoring Armenia to the West, and providing Yerevan with greater strategic options and independence in dealing with regional powers.

The U.S. has double tax treaties with many small countries, including Estonia, Jamaica, Latvia, Lithuania, Malta, and Slovenia. Armenia has double tax treaties with many advanced countries, including Austria, Belgium, Canada, China, France, Italy, the Netherlands, Poland, Russia, and the United Kingdom.

For the latest ANCA fact sheet about the benefits of an updated U.S.-Armenia Double Tax treaty, visit: https://anca.org/taxtreaty

The full text of the Valadao-Sherman letter is online at:

http://anca.org/assets/pdf/020618_valadao_sherman_armeniatax.pdf

The full text of the 2016 U.S. Model Tax Treaty is available at:

https://www.treasury.gov/resource-center/tax-policy/treaties/Documents/Treaty-US%20Model-2016.pdf

Provided below is Article 26 of the 2016 U.S. Model Tax Treaty, which addresses the open exchange of information.

***

2016 U.S. Model Tax Treaty Article 26:

EXCHANGE OF INFORMATION AND ADMINISTRATIVE ASSISTANCE

- The competent authorities of the Contracting States shall exchange such information as is foreseeably relevant for carrying out the provisions of this Convention or the domestic laws of the Contracting States concerning taxes of every kind imposed by a Contracting State to the extent that the taxation thereunder is not contrary to the Convention, including information relating to the assessment or collection, or administration of, the enforcement or prosecution in respect of, or the determination of appeals in relation to, such taxes. The exchange of information is not restricted by paragraph 1 of Article 1 (General Scope) or Article 2 (Taxes Covered).

- Any information received under this Article by a Contracting State shall be treated as secret in the same manner as information obtained under the domestic law of that Contracting State and shall be disclosed only to persons or authorities (including courts and administrative bodies) involved in the assessment, collection, or administration of, the enforcement or prosecution in respect of, or the determination of appeals in relation to, the taxes referred to in paragraph 1 of this Article, or the oversight of such functions. Such persons or authorities shall use the information only for such purposes. They may disclose the information in public court proceedings or in judicial decisions. Notwithstanding the preceding sentences of this paragraph, the competent authority of the Contracting State that receives information under the provisions of this Article may, with the written consent of the Contracting State that provided the information, also make available that information for other purposes allowed under the provisions of a mutual legal assistance treaty in force between the Contracting States that allows for the exchange of tax information.

- In no case shall the provisions of paragraphs 1 and 2 of this Article be construed so as to impose on a Contracting State the obligation:

a) to carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State;

b) to supply information that is not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State; or

c) to supply information that would disclose any trade, business, industrial, commercial, or professional secret or trade process, or information the disclosure of which would be contrary to public policy. - If information is requested by a Contracting State in accordance with this Article, the other Contracting State shall use its information gathering measures to obtain the requested information, even though that other Contracting State may not need such information for its own tax purposes. The obligation contained in the preceding sentence is subject to the limitations of paragraph 3 of this Article but in no case shall such limitations be construed to permit a Contracting State to decline to supply information solely because it has no domestic interest in such information.

- In no case shall the provisions of paragraph 3 of this Article be construed to permit a Contracting State to decline to supply information solely because the information is held by a bank, other financial institution, nominee or person acting in an agency or a fiduciary capacity or because it relates to ownership interests in a person.

- If specifically requested by the competent authority of a Contracting State, the competent authority of the other Contracting State shall provide information under this Article in the form of depositions of witnesses and authenticated copies of unedited original documents (including books, papers, statements, records, accounts, and writings).

- Each of the Contracting States shall endeavor to collect on behalf of the other Contracting State such amounts as may be necessary to ensure that relief granted by the Convention from taxation imposed by that other Contracting State does not inure to the benefit of persons not entitled thereto. This paragraph shall not impose upon either of the Contracting States the obligation to carry out administrative measures that would be contrary to its sovereignty, security, or public policy.

- The requested Contracting State shall allow representatives of the requesting Contracting State to interview individuals and examine books and records in the requested Contracting State with the consent of the persons subject to examination.

- The competent authorities of the Contracting States may develop an agreement upon the mode of application of this Article, including agreement to ensure comparable levels of assistance to each of the Contracting States, but in no case will the lack of such agreement relieve a Contracting State of its obligations under this Article.

Author information

The post ANCA Renews Drive for U.S.-Armenia Double Tax Treaty appeared first on The Armenian Weekly.

Source: Armenian Weekly

Link: ANCA Renews Drive for U.S.-Armenia Double Tax Treaty